The economic dynamics and investment landscape in east Africa present numerous business opportunities for investors looking to tap into the growth potential of the region. The East African Community (EAC), which comprises Burundi, the Democratic Republic of Congo, Kenya, Rwanda, South Sudan, Tanzania, Uganda, and the newly admitted member Somalia, offers exciting prospects for investments.

According to IMF’s Regional Economic Outlook for 2023, the East African Community (EAC) is on a trajectory of substantial economic growth, with region’s real GDP accelerating to 5.7 percent in 2024. The region will register the highest regional economic performance in Africa in 2024, with growth figures at over 5 percent, according to the African Development Bank’s 2023 East Africa Economic Outlook

While the substantial growth is not equally distributed among member countries, the remarkable achievements of the Democratic Republic of the Congo and Rwanda, which are projected to grow at 7.2% and 8.0%, respectively, in 2024, according to the African Economic Outlook 2023, are commendable. The Democratic Republic of the Congo and Rwanda are among the world’s highest-growing economies in 2024, according to the World Bank’s report on Global Economic Prospects. For instance, Rwanda’s robust digital infrastructure, renewable energy capacity, and favourable economic and political landscape make it the largest economy in East Africa and a significant player in Sub-Saharan Africa.

The EAC’s development far outpaces the sub-Saharan African average, demonstrating the region’s economic vibrancy and the efficacy of its collaborative policies.

WHY EAC?

Ranked number one in Africa by sub-regional population, EAC boasts assets such as political stability, an English-speaking and enterprising workforce, a strategic location, and exceptional natural resources, all of which make the region appealing to investors.

According to a report from Journal Economic Analysis on the attractiveness of the East African Community (EAC) for Foreign Direct Investment, some of the main strengths of the EAC relevant for attracting FDI include fast economic growth, relatively low general government debt, relatively low cost of labour, geographical proximity to regional markets and international markets (special agreements with the EU, US, China, and India), and a high share of young people involved in primary education.

Additionally, the free visa policies of Kenya and Rwanda will substantially bolster economic activities in the tourism sector of the region, enhance regional integration and economic inclusion, and attract global investors to the region.

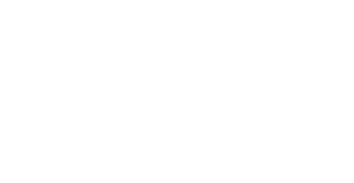

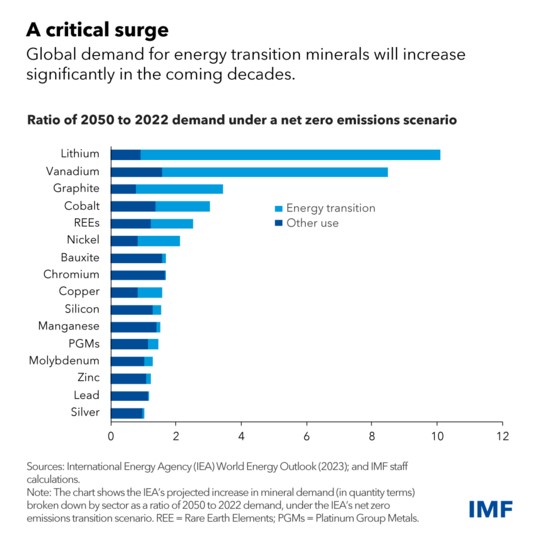

Another comparative advantage of East Africa is its vast reserves of critical minerals. According to UNCTAD’s Economic Development in Africa Report 2023, Africa is home to 48% of the world’s reserves of cobalt and manganese, 80% of the world’s reserves of phosphate rock, and 92% of the world’s reserves of platinum-group metals, which are critical minerals in the production of electric cars, lithium batteries, and hydrogen batteries. Like other African regions, East Africa is also endowed with a variety of minerals, including fluorspar, titanium, zirconium, gold, oil, gas, cobalt, nickel, diamonds, copper, coal, and iron ore. These mineral deposits offer an opportunity for the region’s mining industry’s development.

Opportunities for Sustainable and Renewable Energy Investment

Apart from the region’s investment potential in agricultural businesses, supported by its nutrient-rich soils and a climate favourable to crop growth, the renewable energy sector in East Africa offers excellent prospects for investors. Investing in renewable energy in East Africa can have great benefits on sustainable socioeconomic development of the region by catalyzing economic growth, supporting job creation for the teaming youth, and improve the livelihoods of people in the region.

According to Africa’s Development Dynamics 2023 report, investments have been a major driver of East Africa’s recent growth; however, their allocation towards social and environmental sustainability remains insufficient. Current investments in sustainable energy are insufficient to meet the region’s energy access needs. While the region’s renewable energy sector has grown, most of its potential for sustainable investments has remained untapped.

For instance, despite East Africa’s diverse renewable energy assets, encompassing vast hydro, wind, solar, and geothermal energy resources, only 4% of greenfield foreign direct investment inflows into the region were directed at renewable energy projects during 2017–2022, compared to 17% for Africa as a whole. One of East Africa’s economic ambitions today is to develop its infrastructure, especially sustainable energy infrastructure.

In a recent development, in recognition of the low level of clean energy in Global South countries, which include east African countries, at the just concluded Davos 2024, the World Economic Forum announced the launch of a new alliance to provide a platform for developing economies like East Africa and other emerging markets to raise awareness about their clean energy needs, share best practices, and sustainably accelerate their energy transitions.

Past investment in the sustainable and renewable energy sector in the region includes the construction of the first solar photovoltaic park in Tanzania with a projected capacity of 150 megawatts, the second largest solar PV plant in East Africa. Kenya’s Power and Lighting Company launched a Last Mile Connectivity campaign, which was financed by the Kenyan Government and the African Development Bank (AfDB) with the aim of providing electricity access to over 300,000 non-commercial households in the first phase, reports

Similarly, Uganda is endowed with renewable energy sources, particularly hydro, biomass, and solar. Biomass accounts for 94 percent of the country’s energy consumption and is followed by hydroelectric.

With investment-appealing features such as political stability, an English-speaking and enterprising workforce, a strategic location, and exceptional natural resources, the region possesses high potential for innovative and sustainable investment to accelerate the uptake of renewable energies and contribute to the productive transformation of the continent. East Africa holds unique potential for renewable energies. The East African region is also seeing a growing interest in the renewable energy sector driven by the high costs of fossil fuels, the need to reduce greenhouse gas emissions, and the challenges of climate change, which make investments in clean yet renewable energy more attractive in the region.

However, ineffective energy regulation, poor energy infrastructure, and unstable macroeconomic conditions, exacerbated by recent global shocks, weigh negatively on investor confidence in most East African countries. Africa’s Development Dynamics 2023 Report noted that suitable and renewable energies are core to East Africa’s goal to expanding access to electricity and clean cooking while supporting entrepreneurship and the region’s productive transformation. At the end of 2020, 49% of the population had access to electricity, and only 14% had access to clean cooking. Nonetheless, innovative enterprises are growing across the region and offer the potential to catalyse more investments in renewable energies and support productive transformation in the region.

According to the United Nations’ Renewable Energy in Africa: Prospects and Limits report, Africa has substantial new and renewable energy resources, most of which are under-exploited. Countries in the region have significant potential for renewable energy, particularly hydropower, solar, and wind. The report noted that only about 7% of Africa’s enormous hydropower potential has been harnessed. Existing estimates of hydro potential do not include small, mini, and micro hydro opportunities, which are also significant. Geothermal energy potential stands at 9000 MW, but only about 60 MW has been exploited in Kenya. Based on the limited initiatives that have been undertaken to date, renewable energy technologies (RETs) could contribute significantly to the development of the energy sector in eastern African countries. Renewable energy technologies (RETs) provide attractive, environmentally sound technology options for Africa’s electricity industry.

In the build-up to the UK-African Summit scheduled to take place in April 2024, UK and Rwandan business leaders, investors, and senior government officials will converge in Kigali from January 29 to 31, for the inaugural UK-Rwanda Business Forum, a Pre-event for the UK-African Investment Summit, to discuss business and investment opportunities in Rwanda and, by extension, the East African region. It is hoped that the forum will attract high-quality British investment in sustainable, yet renewable, energy to the region and further open opportunities for new investments from other parts of the world to East Africa.

As a leading African trade and investment firm focused on guiding existing and potential firms in Africa on their ESG and sustainability investments in Africa, our network of experts on the ground in east Africa can guide you in successfully exploring the untapped potential in the region. From Kenya, Rwanda, the DR Congo, and other countries in the region and across the continent, our experience and expertise will help your organisation successfully navigate the complexities of the East African market.

Image by ASphotofamily on Freepik